| |

|

ISSUE |

TEN |

Q2 |

2025 |

|

A N S W E R S |

| OUT |

LOUD |

|

| |

| FINANCIAL SERVICES NEWSLETTER |

| |

|

| INNOVATION |

|

| STOREFRONT |

|

| ONLINE LENDING |

|

| Texting – Upping your game with TotalText |

| By Scott Merritt |

|

|

In today's digital era, effective communication is paramount for the success of online lending businesses. Traditional methods like phone calls and emails often fail to meet the immediacy that borrowers expect. Text messaging has emerged as a powerful tool, offering numerous benefits that can transform the lending process.

Statistics reveal that text messages boast a 98% open rate, with 95% of texts read within three minutes of receipt. This immediacy ensures that borrowers receive and read important information promptly. Moreover, 85% of consumers prefer receiving text messages over a phone call or email, highlighting the growing demand for SMS communication.

Integrating text messaging into your lending operations can significantly enhance various aspects of the business. For instance, 95% of lenders believe that texting speeds up the loan process, leading to more loans, happier borrowers, and increased revenue. Additionally, businesses experience 98% open rates and 36% click-through rates for special offers sent via text, indicating high engagement levels.

In today’s digital world, security is paramount. Tier3 LMS safeguards sensitive information while facilitating real-time credit checks, instant bank verifications, and electronic signatures. Compliance is the top priority, whether for state-licensed, tribal, or other lending models.

Introducing TotalText, your comprehensive customer communication and marketing suite designed to work seamlessly with any backend text provider. TotalText streamlines communication, improves borrower engagement, and accelerates the loan process—all while ensuring compliance with industry regulations.

With TotalText, lenders can increase application completion rates by sending automated reminders that reduce drop-offs. The platform enhances the customer experience by providing instant answers to borrower questions via SMS, leading to higher satisfaction. Faster loan approvals are also achievable, as TotalText allows for real-time text updates to collect documents and verifications efficiently.

Moreover, TotalText helps lenders increase on-time payments through consistent, event-driven messaging. The platform is designed with security and compliance in mind, offering opt-in/out management, single-day text limits, time and date message restrictions, scheduled tasks, text templates, and role-based CSR user access. These features ensure that every message sent meets industry regulations while maintaining operational efficiency.

Beyond compliance, TotalText offers a two-way communication system that allows instant contact and replies, fostering a seamless borrower experience. Multi-language support enables lenders to communicate with customers in their preferred language, improving engagement and accessibility. Furthermore, a comprehensive reporting suite provides detailed message histories, campaign tracking, and performance insights, empowering lenders with valuable data.

Despite its robust capabilities, TotalText remains a cost-effective solution. It costs only pennies per text, and with high volumes, lenders pay just fractions of a cent per message. This affordability, combined with its powerful features, makes TotalText an essential tool for any online lender looking to optimize communication and drive business growth.

|

|

|

|

TotalText - Enterprise Level Texting and Marketing Suite

| PARTNER SPOTLIGHT |

| |

|

| |

| LendAPI simplifies loan originations, decision-making, and compliance. |

|

|

Its ready-to-use application flow template can be quickly customized with the Product Builder, and it connects seamlessly to standard loan management systems, identity verification bureaus, and credit bureaus.

The visual Decision Engine allows risk managers to set up, test, and deploy custom rules and variables for identity verification, bank account analysis, and credit checks—all within one interface. It also coordinates rule outcomes with customer communications and application workflow orchestration, aiming to maximize approval rates.

On the compliance front, LendAPI maintains essential documentation (e.g., consents, promissory notes) and offers state-by-state customization of rules, pricing, and documentation. All key records are stored for back-office reference and are accessible to customers via their portal, ensuring transparency and regulatory adherence.

|

|

|

|

| |

| |

|

| |

| Grow Your Business with confidence. |

|

|

We've been providing growth-focused customers with the resources and peace of mind they need since 1926.

At Surety Bank, we pride ourselves on delivering experienced, community-driven service from real people. From Business and MSB banking to Personal Checking and Savings, you can rely on Surety for individual support on every account and every need.

Experience the Surety difference. A business checking account can seem insignificant until it doesn't work for your business. Our accounts come equipped with all the flexibility and service you need to keep your business running smoothly.

Efficiency and security. If you are managing your Surety Bank accounts without the business online banking platform, enroll today and save yourself a lot of time and effort.

|

|

|

|

|

|

|

| COMPLIANCE CORNER |

|

|

CFPB Shifts Focus Away from Payday Loan Penalties, Prioritizing Consumer Protection

The Consumer Financial Protection Bureau (CFPB) has announced that it will not prioritize enforcement of penalties related to the Payment Withdrawal and Payment Disclosure provisions under its Payday, Vehicle Title, and Certain High-Cost Installment Loans Regulation. These provisions are set to take effect on March 30, 2025.

Instead, the CFPB plans to concentrate its enforcement efforts on more urgent consumer protection issues, particularly those affecting servicemembers, veterans, and small businesses. This move reflects the Bureau’s commitment to safeguarding financial well-being while ensuring resources are directed toward pressing threats.

Additionally, the CFPB is considering issuing a notice of proposed rulemaking to narrow the scope of the regulation. This potential revision suggests a reevaluation of how payday lending regulations impact consumers and financial institutions.

As the guidance doesn't explicity spell out the rules have been terminated, we've worked hard to ensure that Tier3 supports the the payment rules as originally planned for the March 2025 deadline.

Let us know if you are planning on following the latest guidance or implementing the new payment rules to your lending operation. We will be watching closely for further updates on the Bureau’s approach to enforcement and potential rule changes.

|

|

| |

| By Nick Filar |

|

|

The Tier3 maintenance section allows you to create new clients, merge duplicates, and search for existing ones. These features also apply to issuers, corporate clients, banks, and more. This guide explains how to use these options to create, merge, and search for clients.

Creating New Clients

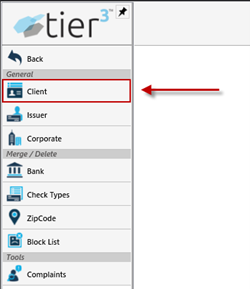

From the main Tier3 menu, click the "Maintenance" button, then click "Client."

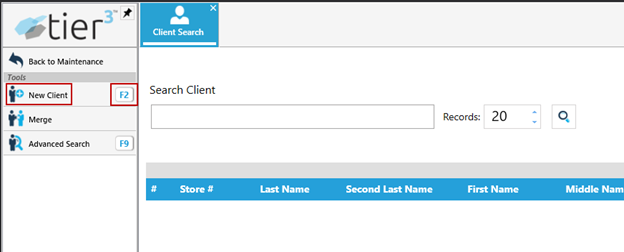

Create a new client by pressing F2 or selecting the button in the context menu:

Complete the client setup with the required information and click the "Save" button.

Merging Duplicate Clients

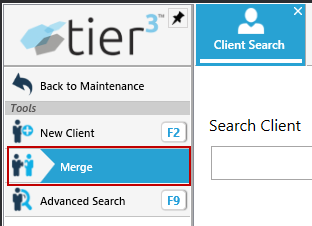

In the Maintenance > Client context menu, click the "Merge" button to open the client merge feature:

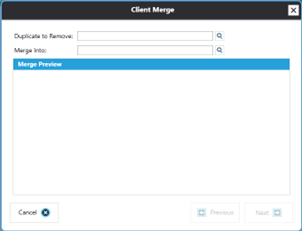

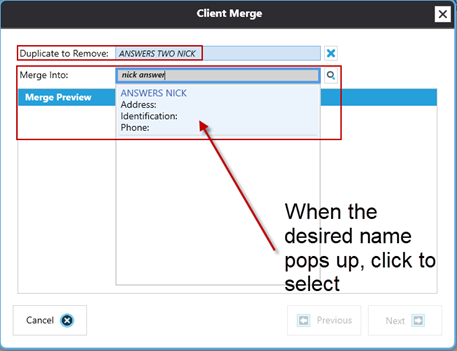

Here, you can enter the duplicate client to remove. In my example, we’ll search for "Nick Answers Two" and select it. Then, in the "Merge Into" field, search for the client to keep. In my example, it’s "Nick Answers:"

As you enter the name, results will auto-populate. In this instance, I searched "Nick Answers," and the resulting name was found.

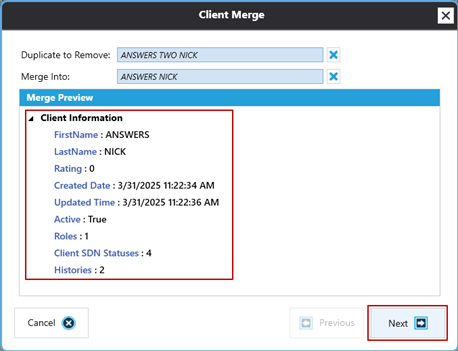

The client merge box will now show the client information for the clients to be combined:

Click "Next" to proceed if everything looks correct. On the next screen, you’ll be notified that this action cannot be undone. Once the merge is complete, the previous duplicate cannot be recovered. Click "Merge" when ready. You’re done!

Searching for Clients

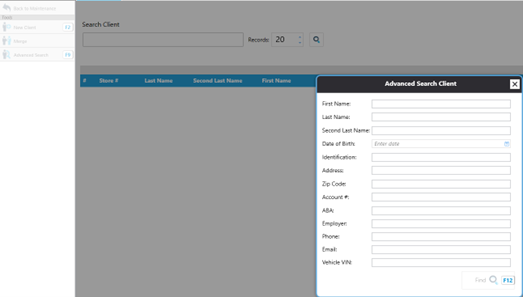

The search box in Maintenance > Clients allows you to search for clients by name, phone number, Tier3 client number, ID numbers, and more. You can also limit the results to a desired number of records; the default is 20.

Additionally, the "Advanced Search" feature lets you search for clients using options like date of birth, bank account numbers, employers, vehicle VIN, email, and more:

Our goal is to provide you with industry-leading solutions. If your team needs assistance with navigating Client Maintenance, creating clients, performing merges, or using the search feature, please contact Answers Technical Support.

|

|

|

| Checked Out |

by Tim Mackin |

|

| |

| |

| Tidbits |

|

|

Bananas are berries, but strawberries aren’t. |

|

|

Octopuses have three hearts, and their blood is blue. |

|

|

A day on Venus is longer than a year on Venus. |

|

|

Nick Filar, Tech Support Manager, is a former rapper. |

|

|

Wombat poop is cube-shaped to prevent it from rolling away. |

|

|

The Eiffel Tower can grow up to 6 inches due to heat expansion. |

|

| |

|

|

|

|

| Meme Stream |

|

|

| |

| |

| |

|

|

|

| |

| |

|

| |

| We look forward to hearing from you! |

| 800-275-1418 |

| |

| 8713 Airport Freewy, Suite 200 | North Richland Hills, TX 76180 |

| |

|

|

| |

|

| © Copyright 2025 Answers, etc. |

|

|

|